As countries around the world fight high inflation by cooling off their economic productivity, the resulting business downturn has hit the warehouse construction sector hard, according to a report from Interact Analysis.

That trend has come at the same time that retail juggernaut Amazon has decreased its spending on micro-fulfillment infrastructure—after furiously doubling that capacity between 2020 and 2021—leading to a particular impact on fulfillment center construction, the London-based consulting firm said. By the numbers, 4,000 fulfillment centers were added to the global building stock in 2022, but that figure is forecasted to decline to 2,000 in 2023.

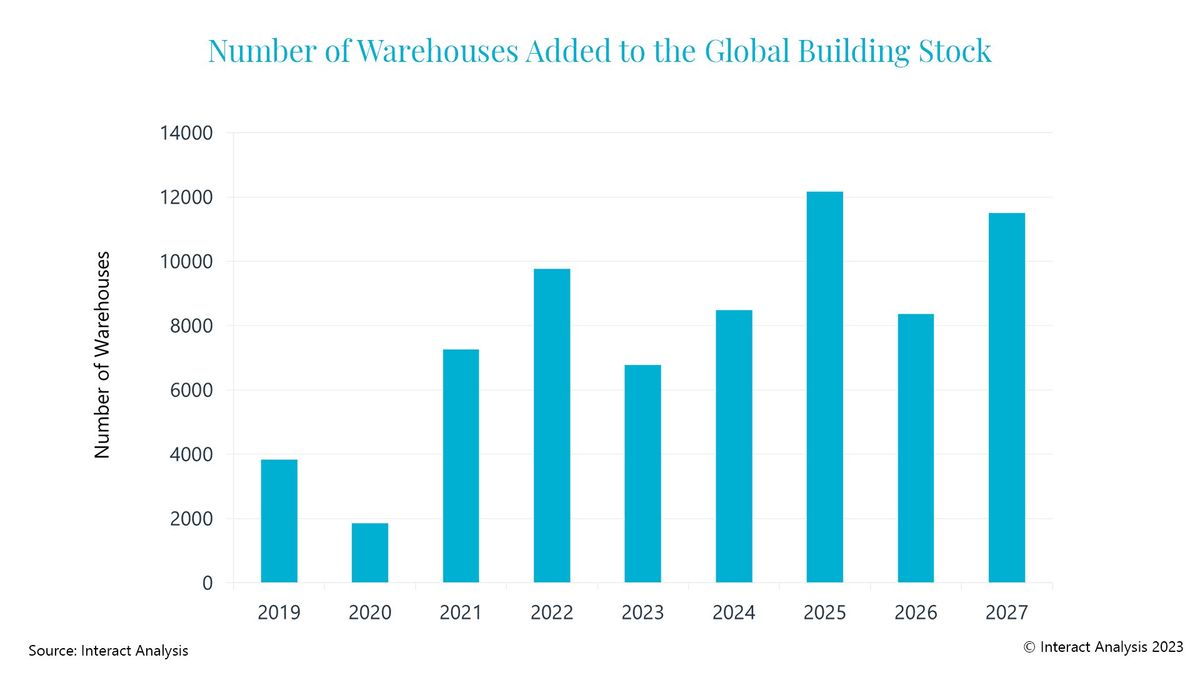

Overall, 6,700 warehouses will be added to the global building stock in 2023, a reduction of 35% compared with 2022, but still higher than pre-COVID levels, Interact Analysis predicted. “Consequently, demand for end-to-end automation solutions will also decrease and the boom we saw during the COVID-19 pandemic will come to an end. Many companies are likely to focus on automating their existing assets rather than investing in new, larger projects,” the firm said.

Overall, China and the U.S. are leading the way in terms of warehouse construction. In 2022, the two countries combined for 58% of total square footage added, as U.S. total warehousing stock increased by 6% over the year and China’s by 5%. The lowest growth in additional warehouse square footage in 2022 occurred in Japan and France.

According to the report, the uptick in durable manufacturing warehouses in Europe and North America was driven by the Inflation Reduction Act, coupled with continued hot e-commerce growth and a trend toward near-shoring.

“It is important to realize the downturn in warehouse construction is not due to a lack of demand. Rather, it is due to high interest rates and poor economic conditions,” Rueben Scriven, Research Manager at Interact Analysis, said in a release. “The slowdown in warehouse construction is likely to be short-lived as the demand for sites is still there. Rent prices are anticipated to increase in the mid-term and e-commerce will continue to drive demand over the long term.”

The report forecasted a decrease in demand for end-to-end automation, but said warehouse automation overall would still continue to rise. The firm found that 18% of all warehouses had some form of automation installed by the end of 2022, and that rate will increase to 26% by the end of 2027.